All web content is supplied on an "as is" basis, with no service warranties of any type of kind whatsoever. Information from this paper might be utilized with correct attribution. Modification of this paper or its material is purely prohibited.

- Mortgage Loans come with longer repayment tenures than personal developments.

- If the home mortgage is an adjustable-rate funding, the payment will certainly transform occasionally as the rate of interest on the car loan changes.

- To discover what prices are presently available, compare quotes from numerous loan providers.

- In this example, the overall price for contrast is 3.40% APRC agent.

Altering your financing to an additional version will certainly attract a conversion cost of Rs.10,000 plus the relevant taxes. If you look for LAPIs, it will certainly be linked to your Flexi Current Account. You have the versatility of withdrawing excess or still cash that is deposited in this account.

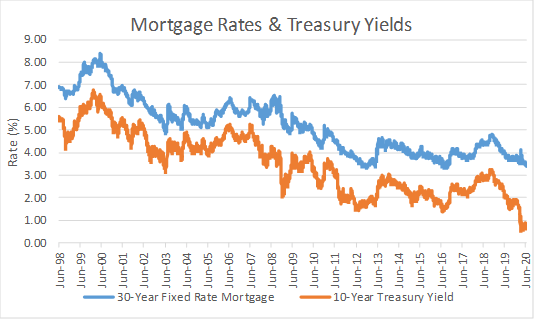

Current Home Loan Prices

Every lending institution will certainly examine your economic situation differently. So obtaining numerous quotes Additional hints will permit you to choose the offer with the very best rate and charges. The price difference between the greatest and lowest prices lending institutions use you could be as high as 0.75%, according to a report by the fintech startup Haus. A home loan price lock allows you to secure the interest rate your lender estimates you for a particular time period. This gives you a possibility to shut on the car loan without taking the chance of an increase in the mortgage rates of interest prior to you wrap http://jeffreyxyzm266.wpsuo.com/what-are-the-different-types-of-home-loans up the loan procedure.

Hsbc Bank

If you prepare to apply now, it's still worth inspecting so you have a great idea of what funding programs you may get andhow your score will influence your rate. Ideally, you desire tocheck your credit scores reportand score at the very least 6 months before obtaining a mortgage. This gives you time to sort out any errors and also make sure your score is as high as feasible.

Shop and also contrast your personalized rates from multiple lending institutions. Our affordable borrowing options, consisting of FHA fundings as well as VA lendings, help make homeownership feasible. Check out our affordability calculator, as well as seek buyer grants in your location. See our home loan education facility for handy pointers and also info. As well as from getting a car loan to managing your home loan, veterans timeshare Chase MyHome has you covered. All residence borrowing items other than IRRRL go through credit scores and also building approval.

Besides, the resale value of a residential property, its location, also affects this interest rate. Mortgage loans are secured lendings that an eligible applicant can avail by keeping a had building as collateral to the financial institution. Lenders normally supply appealing mortgage rates of interest that makes financing repayments affordable and practical. There are various kinds of home loan on the marketplace with various eligibility needs. Not all lending institutions offer all finance types, and rates can vary considerably depending upon the finance type you choose. Some usual mortgage loan products are conventional, FHA, USDA, as well as VA financings.

If that's excessive research, you might deal with a mortgage broker. They work with compensation, which is generally paid by the lender. Adapting ARM Car loans - Adapting rates are for loan amounts not surpassing $548,250 ($822,375 in Alaska and also Hawaii). Adjustable-rate financings as well as prices undergo transform during the loan term.