Customer may open eligible KeyBank accounts to qualify for the interest rate discount. Regular monitoring and savings account service fee use. Refer to particular monitoring or cost savings account disclosures for details. For fixed-rate home mortgages, the 0. 25% rate discount rate is a long-term rates of interest decrease that will be shown in the Promissory Note interest rate.

25% rate discount will use to the preliminary set interest rate duration and will be shown in the optimum amount the interest rate can increase over the term of the loan, based on the minimum interest rate that might be charged per the terms of the Promissory Note. Rate of interest discount might not be readily available for all items - why do mortgage companies sell mortgages.

Ask us for details. Home Mortgage Terms & Conditions: The Annual Portion Rate (APR) is the cost of credit over the term of the loan expressed as an annual rate. The APR shown is based upon rate of interest, points and certain approximated finance charges. Your real APR may be various. Financial investment items used through Secret Investment Solutions LLC (KIS), member FINRA/SIPC and SEC-registered financial investment advisor.

Financial investment items offered through KIS are: NOT FDIC GUARANTEED NOT BANK ENSURED MAY LOSE VALUE NOT A DEPOSIT NOT INSURED BY ANY FEDERAL OR STATE FEDERAL GOVERNMENT AGENCY KIS and KeyBank are separate entities, and when you buy or offer securities you are doing organization with KIS and not KeyBank.

Lenders consider lots of elements before they calculate an interest rate. These elements can impact the rates of interest you may get to buy or re-finance a house or get cash from your home equity. The Fed Funds Rate (that is, the rates of interest at which depository organizations provide cash to each other overnight) is set by the Federal Reserve Board.

Lower rates normally suggest you'll pay less interest. Bear in mind that mortgage rates can fluctuate daily. Register for Watchful eye text notifies. People with higher credit report generally improve rate of interest than people with lower credit rating. Lots of financial experts advise you look for methods to enhance your credit report before you obtain a home loan or refinance your home.

Not known Facts About What Type Of Interest Is Calculated On Home Mortgages

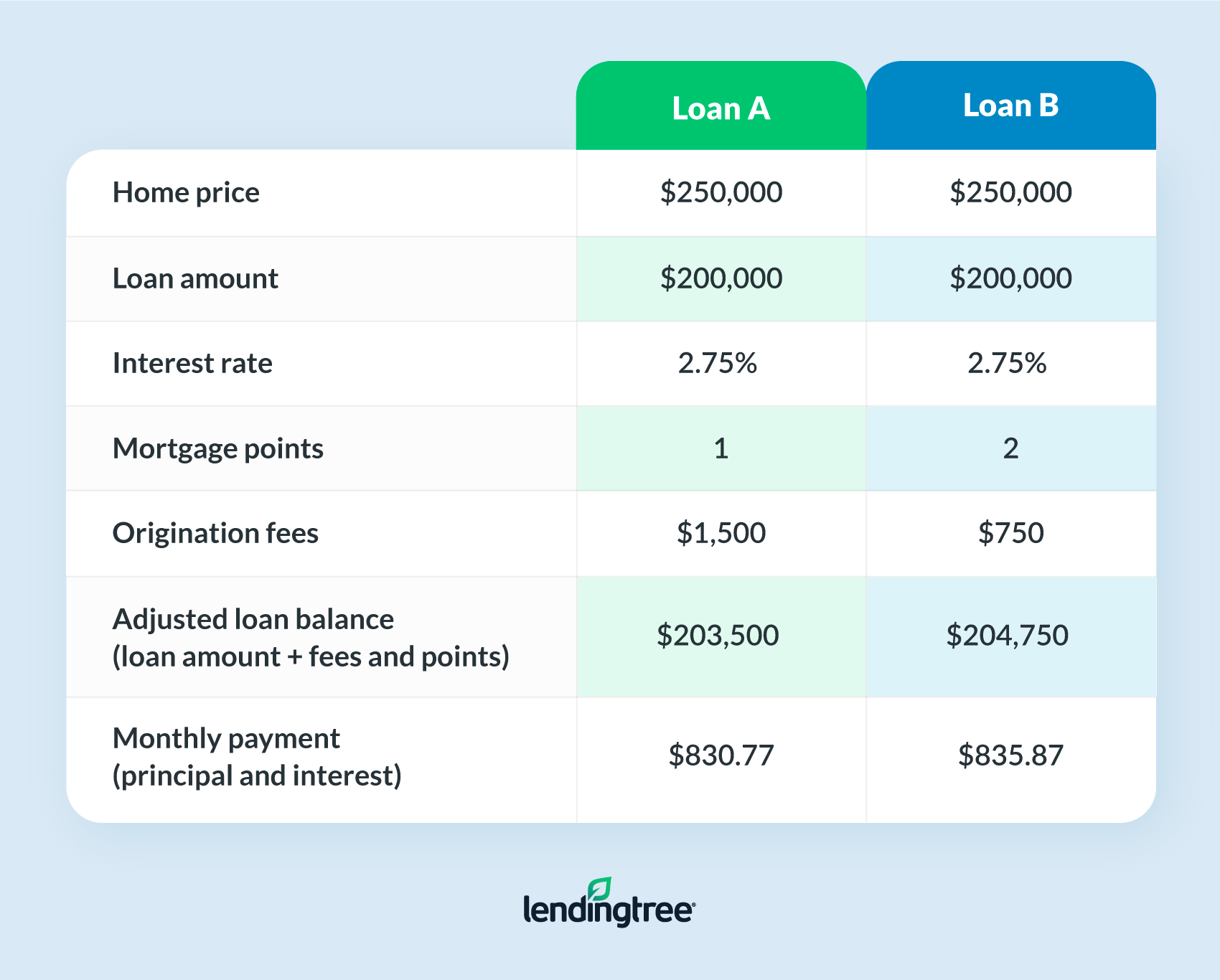

Points are a method to "purchase" a lower interest rate. One point amounts to 1% of the loan quantity. For example, on a $200,000 home mortgage, one point for that home loan would cost $2,000. pueblo bonito timeshare Know offers that reveal a low rates of interest but need you pay points. To better understand the overall expense of a mortgage offer, take a look at its yearly portion rate.

Loan term can affect rate of interest. Longer term loans normally have higher rates of interest than home mortgages with much shorter terms. A shorter-term loan may reduce your interest rate and conserve you cash over the life of the loan. There are lots of types of loans you might get to buy a home, refinance a home, or get cash from your house equity.

Standard loans are provided by personal loan providers without federal government backing. The rate of interest you might get can vary by the type of loan. When loans have a set rate, the amount of money you pay in interest remains the exact same. When loans have an adjustable rate, the amount of money you pay in interest can change in time.

To discover more, see our short article on repaired and adjustable rate home loans. The size of your loan can impact the home loan rate. In some cases loan providers charge a higher interest rate to people who want to obtain bigger amounts of cash than the normal borrower. These home mortgages are often called "jumbo marriott timeshare orlando loans." When you are purchasing a home, the quantity of your deposit can affect your home loan rate.

Lenders see those able to make bigger deposits as less dangerous. Bigger deposits suggest less opportunity you'll leave your https://jaidenaknf178.weebly.com/blog/some-ideas-on-how-fha-mortgages-work-you-should-know home and lose the worth of your down payment. Another method to think about a down payment's impact on your home mortgage rate is to determine a loan-to-value ratio (or "LTV").

For example, if you want to purchase a $250,000 home with a $50,000 deposit and a $200,000 mortgage, then your LTV is 80%. (That is, $200,000 $250,000 = 0. 80 or 80%.) Lenders tend to see home loans with higher loan-to-value ratios as more risky than home loans with lower LTVs, and many charge greater rates of interest as an outcome.

What Are The Best Interest Rates On Mortgages Can Be Fun For Anyone

Lenders consider your home's fair market value to compute your loan-to-value ratio throughout a refinance because your house's worth might have changed since you bought or last refinanced. For example, if the house you purchased for $250,000 is now worth $300,000, and you owe $180,000 on the mortgage, then your LTV is 60%.

60 or 60%.) Lenders typically see re-finance loans with lower loan-to-value ratios as less risky, and might offer a lower rate of interest as a result. Remember that squander refinances tend to increase your LTV. With a cash out re-finance, you replace your current home loan with a new home loan for a greater amount and get the difference in money at closing.

That implies the quantity of your new home loan will be $210,000 and your LTV will be 70%. ($210,000 $300,000 = 0. 70 or 70%.) This higher loan-to-value ratio may affect your mortgage interest rate. Liberty Mortgage customers can log into their accounts to see if they have a present interest rate deal.

In order to get involved, the borrower needs to concur that the lender, Quicken Loans, might share their details with Charles Schwab Bank and Charles Schwab Bank will share their info with the loan provider Quicken Loans. Absolutely nothing herein is or should be translated as a commitment to lend. Loans undergo credit and collateral approval.

This deal goes through change or withdraw at any time and without notification. Rate of interest discount rates can not be combined with any other deals or rate discounts. Hazard insurance coverage may be needed. 1. Loans are qualified for just one Financier Benefit Prices discount rate per loan. Select home loan are qualified for a rate of interest discount rate of 0.

750% based upon certifying properties of $250,000 or higher. Discount for ARMs uses to initial fixed-rate period only. Certifying assets are based upon Schwab brokerage and Schwab Bank integrated account balances, including: a) Brokerage accounts in which the borrower(s) is an owner, trustee or custodian; b) Standard, Roth, and Rollover Individual Retirement accounts (IRA)* - individually owned or inherited.

Rumored Buzz on What Is A Basis Point In Mortgages

(Excluding Service Pension such as Easy Individual Retirement Account, SEP IRA & Pension Trust). * Clients of Independent Investment Advisors: IRA account balance eligibility is not available for clients of independent investment consultants. Qualifying possessions are based upon Schwab and Schwab Bank combined non-retirement account balances. For additional details please see and log into www.