45( a). Charging unearned fees may be thought about misleading for the following factors. First, by wrongly representing on the HUD-1 Settlement Declaration that points are discount rate points, a banks might deceive clients into thinking they were receiving a discount rate off the par rate of interest. When examining the realities, examiners could consider whether loan officers knew, prior to loan closing, what the rate of interest deduction must have been relative to the discount rate points charged and whether borrowers were notified that either the discount costs would not result in a proportional discount rate in the rate of interest or that no discount would be provided.

Finally, the misrepresentation would be thought about product if it worried a sufficiently large amount of unearned fees or impacted a large group of debtors. Claims made with the knowledge that they are false should be presumed to be product. For example, a monetary organization's understanding that fees divulged as discount rate points on a HUD-1 Settlement Statement were not, in truth, leading to a commensurate discount to debtors would be presumed material (what is the current interest rate for home mortgages).

Charging unearned discount points can also have reasonable financing implications. If a creditor charges discount points without really lowering the rate and the practice has a prohibited diverse impact, the practice could break the ECOA, as carried out by Guideline B, and the FHA. Regulation B prohibits discrimination against a candidate on a prohibited basis (race, color, religious beliefs, national origin, sex, marital status, age, invoice of public help, or exercising rights under the Customer Credit Security Act) regarding any aspect of a credit transaction.

1002. 4( a). As discussed in the Authorities Personnel Commentary, the ECOA and Regulation B "may restrict a financial institution practice that is discriminatory in impact because it has a disproportionately negative effect on more info a forbidden basis, despite the fact that the lender has no intent to discriminate and the practice appears neutral on its face, unless the lender's practice meets a genuine company need that can not fairly be accomplished as well by ways that are less disparate in their impact." Likewise, area 3605 of the FHA restricts discrimination in property property deals because of race, color, religious beliefs, sex, handicap, familial status, or nationwide origin.

Sometimes, loan officers charged customers discount rate points without a commensurate reduction in the note rate. An analytical analysis of the debtors exposes that the practice had a diverse influence on Hispanic debtors. Of the 100 Hispanic borrowers, 40 paid unearned discount rate points (40 percent). Of the 80 non-Hispanic white borrowers, 20 paid unearned discount points (25 percent).

Unknown Facts About What Are The Best Banks For Mortgages

This distinction is statistically significant at the 5 percent level. If the lender in this circumstance can not offer a genuine service justification for these variations, the practice could constitute a pattern or practice of credit discrimination in violation of the FHA, the ECOA, and Regulation B. Area 706( g) of the ECOA, 15 U.S.C.

Department of Justice when a federal banking firm has reason to think that a financial institution has breached section 701( a) of the ECOA by participating in a pattern or practice of discrimination and provides discretionary referral authority for specific offenses of section 701( a), 15 U.S.C. 1691( a). In Freeman v. Quicken Loans, Inc., 132 S.

2034 (2012 ), the U.S. Supreme Court recently narrowed considerably the situations in which an unearned cost will breach area 8( b) of the Property Settlement Procedures Act (RESPA). The Supreme Court unanimously concluded, based on the statutory language, that an area 8( b) offense for an unearned fee should include "a charge for settlement services [that] was divided in between 2 or more individuals." Since the complainants in Freeman did not declare that Quicken split discount points with anybody else, the court verified the dismissal of the case.

On August 17, 2012, the CFPB provided a rulemaking proposal under Regulation Z to execute home mortgage arrangements in Title XIV of the Dodd-Frank Act, including a provision in section 1403 limiting discount rate points. To protect consumers while enabling lenders to continue providing mortgages with discount points, the CFPB proposed two requirements for discount points.

Second, the customer needs to receive an authentic decrease in the rate of interest of the loan with discount points compared to the rates of interest on the alternative loan without discount points. Talk about the proposal are due by October 16, 2012. The CFPB anticipates https://blogfreely.net/tyrelap46a/if-they-wish-to-make-monthly-payments-and-utilize-some-of-the-money-for-other to provide a final rule by January 21, 2013, as needed by area 1400( c)( 1) of the Dodd-Frank Act.

6 Easy Facts About What Are Current Interest Rates On Mortgages Shown

Policies, treatments, and manages related to home mortgage loan prices must suffice to prevent loan officers from representing to debtors that the rate was decreased due to the fact that the borrowers acquired discount rate points without actually reducing the rate. A loan provider's prices policy or guidelines need to be particular and state that loan officers are prohibited from charging discount points that do not lead to a proportional lowering of the rate of interest.

However, charging unearned discount points can result in offenses of laws and regulations and increased legal and reputational threats for financial institutions - how to qualify for two mortgages. Such violations could also lead to needed removal to affected debtors and other supervisory actions, including a possible recommendation to the U.S. Department of Justice if there is a reasonable lending offense.

Home mortgage come in variations of these categories, and home mortgage rates can differ by loan type: consist of home loans insured by the Federal Housing Administration (FHA loans) and mortgages guaranteed by the Department of Veterans Affairs (VA loans) and the Department of Agriculture (USDA loans). These loans have lax credentials requirements and are attractive to first-time house purchasers.

tend to be plain-vanilla house loans that meet qualifications set by home mortgage giants Fannie Mae and Freddie Mac. They typically have higher minimum credit ratings than government-backed loans. Home mortgage rates for these loans can be beneficial due to the fact that lenders typically believe they are lending to lower-risk debtors (how are adjustable rate mortgages calculated). A fixed-rate loan has one interest rate over the life of the home loan, so that the monthly principal-and-interest payments stay the same up until the loan is paid off.

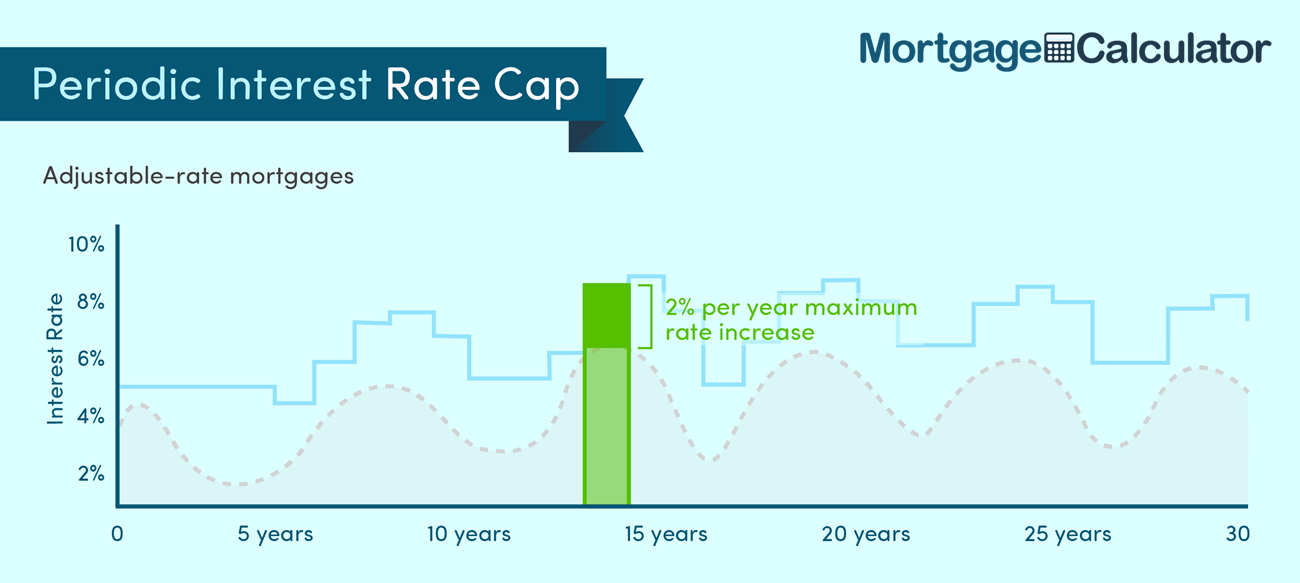

ARMs typically begin with a low rate of interest for the first couple of years, however that rate can go higher. MORE: The term is the variety of years it will take to pay off the home mortgage. The most typical mortgage term is thirty years. Another alternative is the $115-year term, which is popular for refinancing.

An Unbiased View of What Is The Debt To Income Ratio For Conventional Mortgages

But over the loan's life, i just bought a timeshare can i cancel you pay more interest on a term than a 15-year term because you're making twice as lots of payments. Shorter-term home loans normally have lower home loan rates than long-term loans. Borrowers might select other terms, such as 20 or ten years. There is a limit on the size of a loan that Fannie Mae and Freddie Mac will back.

The adhering limitation varies by county and might be changed each year. A is a home mortgage for more than the adhering limit. The financing requirements tend to be more stringent for jumbo loans: They typically require higher minimum credit history, deposits and debt-to-income ratios than adhering loans. Again, loan provider risk drives your mortgage rate here.